| Department of Economics |

| NEWS & MEDIA |

MEDIA

|

IMPACT OF COVID ON PAKISTANI EXPORTS: A SURVEY OF EXPORTERS |

|

Azam Chaudhry, Aimal Tanvir, Saffa Imran, Zoha Awais, and Anam Ali |

Background of Exporter Survey

The coronavirus pandemic reached Pakistan in March 2020 and like many others, the government responded with a series of lockdowns to limit the spread of the virus. The Innovation Technology Center (ITC) at Lahore School of Economics conducted a survey of exporters in June 2020 to measure the impact of the pandemic on export performance during the last few months. The sample size for this survey was 130 firms and the sampling frame consisted of exporters from Karachi, Lahore, Sialkot and Faisalabad. The majority of the surveyed exporting firms were from the textile sector while most of the other firms were sports and surgical goods exporters. The firms in the textile sector and the sports goods sector were mostly medium sized firms whereas the majority from the surgical goods sector were small firms. Below are some of the findings from the survey. |

Falling Export Volumes Mostly Compensated for by Higher Unit Prices

Export values did not change for a majority of respondents during the pandemic, with 58% of exporting firms reporting no change in their export value over the last three months. However, export volumes have fallen overall dramatically because of the global pandemic with 75% of firms reporting a fall in their export volumes. This relative stability in export values, with falling export volumes, was the result of an increase in average price with 26% of firms reporting an increase in the average price per unit of their exported good during the pandemic.

Falling Export Volumes Mostly Compensated for by Higher Unit Prices

The majority of the firms in the survey reported that the value of their exports remained constant. Decomposing this result by size, we see that almost two-thirds of the medium sized firms and about half of both small and large firms reported that their export values did not change during this three-month period. At the same time, there were still firms that reported a decrease in export values: almost 14% of small firms, 11% of medium firms and 16% of large firms reported a decrease in export values. Some firms were able to take advantage of changes in demand and increase the value of their exports: 8% of small firms, 22% of medium-sized firms and 29% of large firms reported an increase in export value from March to May 2020. What is especially interesting is that while a significant number of firms reported that their export values stayed relatively constant, but there were still significant changes in export volumes. In particular, 82% of medium sized firms reported that their export volumes fell, while both small and large firms reported 74% declines in their export volumes. Finally, there were firms that were forced to stop exporting over the three-month period; this was a particular problem for small exporters where almost 30% of small exporting firms were forced to stop exporting altogether during this three-month period. The survey showed that these seemingly conflicting narratives make sense because average prices of export goods rose while the export volumes fell which led to relatively constant total export values. The survey found that the average price per unit of the exported product rose for small, medium and large sized firms by 25%, 30% and 22.5%, respectively.

More than Half of Textile Exporters Report Stagnant Export Values

Across sectors, most firms reported stagnant export values. There were also firms from all three sectors who reported increases in their export values: surgical good producers experienced the greatest increase in export value with almost 37% of surgical producers reporting an increase in export value. The surgical goods sector experienced the greatest fall in export volumes but this was matched by the largest increase in average unit price:53% of surgical exports reported an increase in average price per unit of the exports while sports goods manufacturers and textile manufacturers reported average unit price increases of 37.5% and 22.2% respectively. At the same time, almost 7% of textile exporters who responded reported that they were forced to shut down.

Twenty-Seven Percent of Firms Exporting to the UK Experienced a Fall in Export Value

There were four primary export destinations reported by the firms, namely, USA, UK, Europe and Asia. Europe was the most popular destination with almost half of the firms reported Europe as their main export destination. Exporters to the UK experienced the most significant fall in export value (with 27% of firms reporting a fall) while almost 9% of exporters to the US reported falls in export values. Also, almost 11% of firms exporting to the US reported that they stopped exporting during the pandemic. Exporters to Asia reported the most significant increases in average price per unit (with almost 50% of these exporters reporting an increase) while 45% of exporters to the UK reported higher prices. The export values for Pakistani exporters to the UK exporters fell despite higher unit prices because export volumes to the UK fell more than the increase in the average prices of exported goods.

Pakistani Exporters Facing Falling Demand

Eighty-two percent of firms surveyed reported lower demand for their products due to the pandemic. This fall in demand has had had the greatest impact on the sports goods sector, with almost 88% reporting a decrease in demand for their products. The textile exporters reported an 83% decrease in demand while the surgical exporters reported a 66% fall in demand for their goods. However, the textile sector has been relatively proactive with 19% of textile exporters switching their production to new products; these new products were mostly Covid-19 related and comprised PPE goods and masks. Export destination also played a role in determining fall in demand: 81% of exporters to the UK reported a fall in demand while 86% percent of exporters to the US and 70% of exporters to Asia faced lower demand.

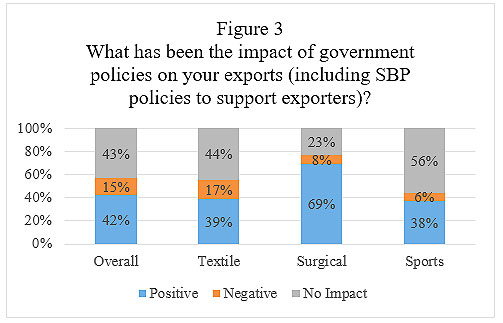

Exporters have a Positive View of Govt Policies Though Depreciation is Reported to have a Negative Impact

Firms were also asked what impact certain government policies had on their exports during the pandemic. Forty-four percent of firms stated that depreciation negatively impacted their exports during the pandemic, while only 16% reported a positive impact of the depreciating rupee on their exports. The survey also asked if government policies had supported exporters during the pandemic: 42% of firms reported a positive impact of government policies on their exports, 43% believed they had no impact while 15% of firms found government policies to have had a negative impact on their exports.

Conclusions

The coronavirus pandemic has led to negative economic consequences in most countries and Pakistan is no exception. The Lahore School of Economics survey of exporters has found that firms did not report significant changes in the value of their exports which is a promising sign for Pakistan’s economy. Decreased demand and decreased export volume is a concern, though at the moment this has been balanced by higher prices of exported goods. There is room for improvement in terms of the support the government can offer to exporters during this turbulent time, though exporters were generally satisfied. But it is important to note that exporters were weary of further currency depreciation. Nonetheless, the future of Pakistani exports is not only dependent on how the pandemic impacts Pakistan, but how the pandemic impacts the export destination countries as well. So, while the value of Pakistani exports has not changed dramatically during the pandemic so far, falling global demand has the potential to hurt future Pakistani exports.

Link to the Article in The Express Tribune:

People

People