| Department of Economics |

| NEWS & MEDIA |

MEDIA

Annual Growth in Pakistan |

Fiscal Year 2023

|

GDP Growth for Fiscal Year 2023

This FY2023 year has also seen a continued slump in the current account balance, with the first three months of successively observed deficits, ranging between $0.7 billion and $1.2 billion. Which adds to the devastating impact of the floods to lower our model’s projection of GDP growth for FY 2023, made in October 2022.

Our model also uniquely estimates a supply shock, positive or negative, but of course being negative with the floods. Which then feeds into a demand shock. To give a final change in GDP for the FY2023.

The unique estimation of the supply cum demand shock, accounts for the difference between our projection of 2.38%, and others.

The methodology of Lahore School’s estimation of GDP growth is year on year. Which makes it globally comparable to most estimation.

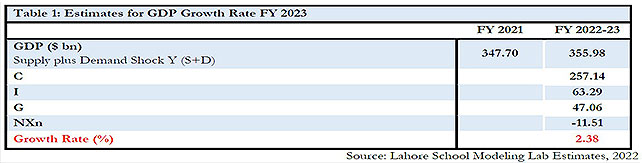

So, Table 1 shows, output in fiscal year 2022-2023 as compared to output in fiscal year 2021- 2022 to give GDP growth for Pakistan of 2.38%.

Table 1: Estimates for GDP Growth Rate FY 2023

This GDP growth for FY2023, is based on a trend expansion of the major macro drivers of growth, consumption, investment, and government expenditure over the year. But is moderated by the major fall in flood driven incomes in Q1, and the major fall in net exports of $11.51 billion.

Methodology

Supply Shocks of FloodsThe annualized changes in GDP growth over FY2023 are given by a series of supply cum demand shocks to the baseline economy.

Negative Supply Shock in FY 2023 of the Devastating Floods as Observed over Q1The supply shock is based on a mapping of sectoral output, gain or loss. Which gives an output gap.

We begin the estimation of the supply shock, by assuming an impact of the floods as observed over Q1, July

to

September 2022. If the impact is observed to persist into Q2, October to December 2022, we will revise

our

current estimate based on just Q1, to Q1 plus Q2.

We add a further caveat, that this estimation of the supply shock delivered by the floods, is based only

on income

loss. It is does not add loss in capital stock. The obvious loss in capital stock due to these floods,

is in rural

housing and infrastructure. The addition of loss in capital stock, can be made theoretically to the loss

in income,

through reduced investment and consumption, to replace lost housing. This additional loss of capital

stock, has

been run by our model, and renders GDP growth for FY 2023 negative.

However, this replacement of housing, can only be observed in Q2 to Q4 of FY 2023, so will only be

incorporated

into revised runs of the model for Q2 to Q4 of FY2023.

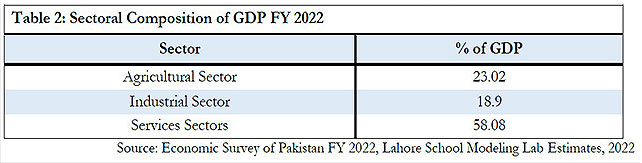

In FY2023, the agricultural sector comprised 23% of GDP. Industry 19%. Services 58%, as Table 2 shows.

Table 2: Sectoral Composition of GDP FY 2022

We begin by estimating the impact of the flood on agriculture, and then project this loss in output for industry.

Impact of the floods on agricultural outputIn Q1 of FY2023, over July to September, the major impact of the floods has been on the

Kharif crop.

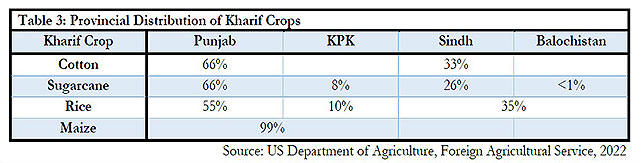

Table 3 gives the provincial distribution of the Kharif crops. The cotton crop has two thirds

share in the Punjab, and a third share in Sindh. Sugarcane again has two thirds share in the

Punjab, a quarter in Sindh, 8% in KPK, and under 1% in Balochistan. Rice has a 55% share in

the Punjab, a 35% share in Sindh and Balochistan combined, and a 10% share in KPK. Maize is

only grown in the Punjab and KPK.

Table 3: Provincial Distribution of Kharif Crops

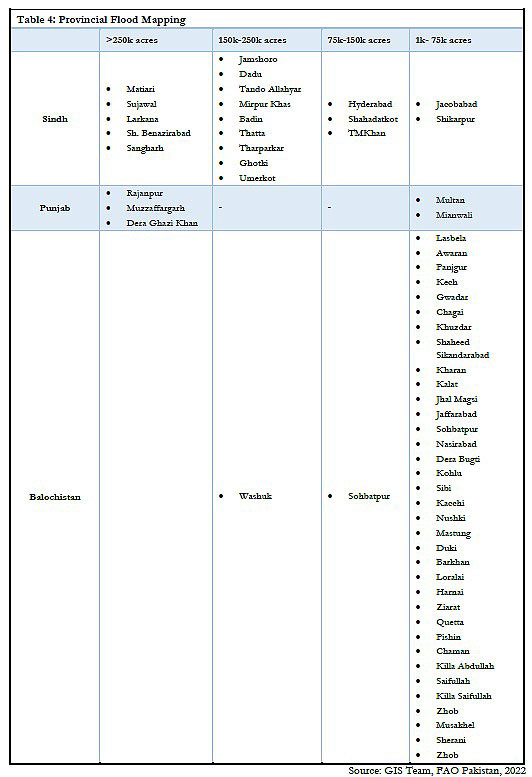

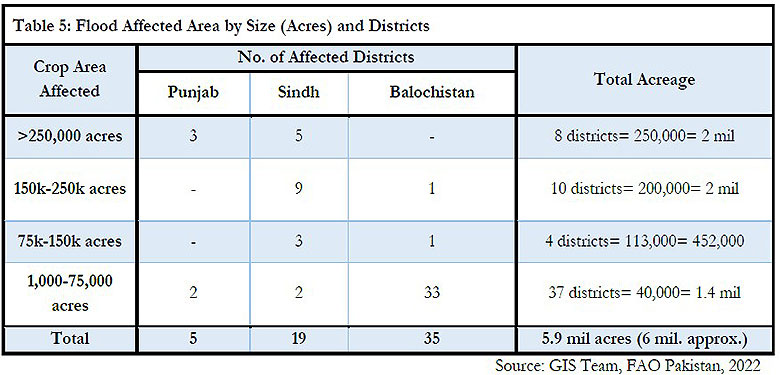

Tables 4 and 5 give a flood mapping of districts in terms of inundated acreage. Four categories of inundation are available. The highest category of inundation is greater than 250,000 acres. The next lower category is between 250,000 acres and 150,000 acres. Further down is the category of 150,000 acres and 75,000 acres. While the lowest category of inundation is 75,000 acres to 1,000 acres.

Table 4: Provincial Flood Mapping

Table 5 summarizes that 3 districts of the Punjab were in the highest category, and two in the lowest category. Giving the Punjab a total of 5 districts affected. Sindh had 5 districts in the highest category, 9 in the next category, 3 in the following category, and 2 in the lowest category. Giving Sindh a total of 19 districts affected. Balochistan had one district in the second highest category, one district in the next lower category, and 33 districts in the lowest category. Giving Balochistan a total of 35 districts affected, albeit thank God predominantly in the lowest category of inundation.

Table 5: Flood Affected Area by Size (Acres) and Districts

To estimate output loss, we need to estimate acreage loss, and use this to estimate output loss.

Table 5 allows an approximation of acreage loss, assuming a floor value for the highest category of inundation, and median values for the other three categories. Which give an aggregated inundation acreage of 6 million.

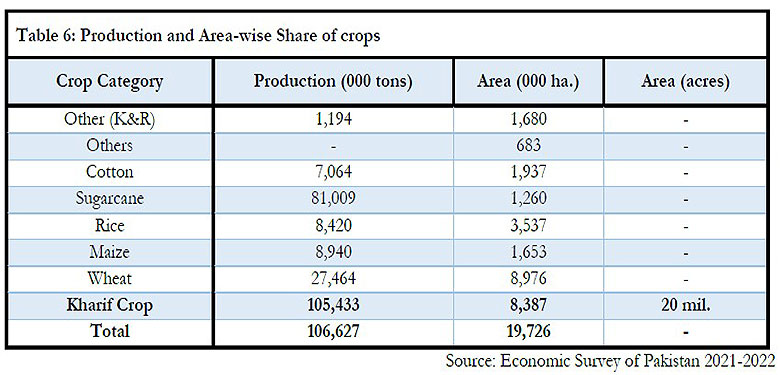

Table 6 gives a total Kharif acreage of 20 million. Giving an acreage loss of 30% of the total Kharif crop.

Table 6: Production and Area-wise Share of crops

Table 6 also correlates total acreage for each crop, to its total output. Which allows us to correlate acreage loss to output loss in Table 7.

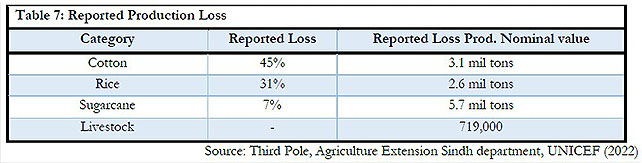

Table 7 shows that an output loss of 45% of the total cotton crop of 7 million tons, translates into 3.1 million tons lost. An output loss of 31% of the total rice crop of 8.4 million tons, translates into 2.6 million tons lost. An output loss of 7% of the total sugarcane crop of 81 million tons, translates into 5.7 million tons lost. And finally, an estimated 0.7 million head of livestock have been lost to the floods.

Table 7: Reported Production Loss

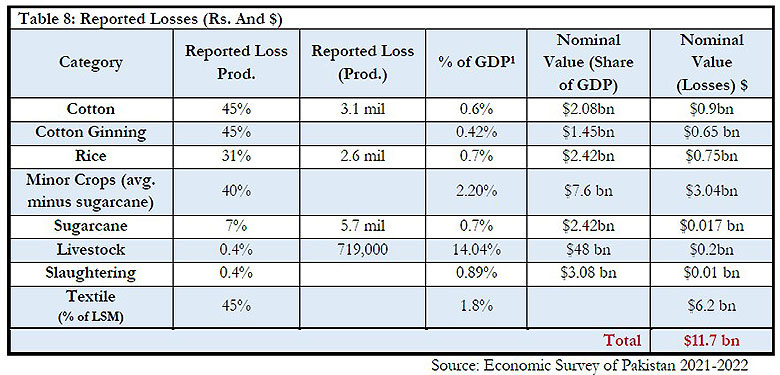

Table 8 is able to price the estimated loss in output. It does this by estimating say the output loss in rice as a share of GDP. The table also gives the total nominal value of cotton in US Dollars in the economy. Then the lost share of cotton in GDP, times the total value of rice in USDs, gives the value of rice lost in USDs.

Table 8: Reported Losses (Rs. And $)

So, in Table 8, for cotton, the estimated loss of output is 45% of the total, or 3.1 million tons. The table next gives the share of the cotton crop in the total GDP of the economy as 0.6%. The total GDP of the economy as given by the IMF for 2021 is $347 billion. Which gives the share of the cotton crop in it of $2.08 billion. The estimated loss in output of the cotton crop of 45%, of the total value of cotton of $2.08 billion, then gives a nominal loss of $0.9 billion.

Similarly, the loss in the rice crop is valued at $0.75 billion. The loss in the sugarcane crop is valued $0.017 billion. The loss in minor crops is valued at $3.04 billion. The loss in livestock is valued at $0.2 billion.

Giving an aggregate value of loss in agriculture of approximately $5 billion.

Impact of the floods on non-Agriculture

This loss in agricultural output implies a huge impact on processing of this output in industry. This loss in non-agriculture is also estimated in Table 8.

A critical assumption has been made in going from the loss in output in agriculture to the loss in value added in non-agriculture. This assumption is that the loss in output in agriculture will be equal to the loss in value added in the processing of that output. So, if there has been a 45% loss in output in the cotton crop, this implies that cotton ginning will also have 45% less cotton to add value to. As will textiles.

The table estimates that the loss in cotton output reduces the value added in cotton ginning by $0.65 billion. The loss in textiles being the highest at $6.2 billion.

The loss in livestock reduces the value added in slaughtering by $0.01 billion.

The total impact of the floods on agriculture and non-agricultureThis gives the total impact of the floods on agriculture and non-agriculture, in Q1 of FY2023, at $11.7 billion.

Estimating an output gap to model the demand shockThe total impact of the floods on agriculture and non-agriculture has to be expressed as an

output gap, to model the demand shock.

This output gap is expressed as the output loss from trend growth.

The sectoral supply shock to output and income then gives a demand shock.

The model takes the baseline economy in the FY22, and subjects it to these supply cum demand

shocks.

Which gives the annualized change in GDP growth over FY2023.

GOP faces an enormous output gap minimally estimated here $12 billion. Its forex reserves have dwindled to $7 billion. With the extension of the IMF’s EFF to calendar year 2023, covering virtually all of FY 2023, its fiscal stance is extremely limited by the terms of the agreement with the IMF.

That does leave it monetary policy to generate growth and support welfare. Monetary policy is primarily occupied with controlling inflation raging at 23% per annum. Largely using the interest rate peaking at 15% per annum.

However, we have argued in the last report on the State of the Economy FY 2022, that at least a quarter of this inflation rate is being contributed to by the massive depreciation of the exchange.

Further, research at the Lahore School shows that depreciation of the exchange rate sets in place depreciationary expectations, leading increase capital outflows, (Mahmood and Chaudry, Lahore Journal of Economics, 2020). Which of course Pakistan’s weak Current and Capital Accounts can ill afford. Nor can a weak investment rate of 16% of GDP.

Therefore, on all these counts, GOP needs to arrest the depreciation of the exchange rate urgently.

Link to the News International

People

People